2015 1st Quarter Economic Indicators

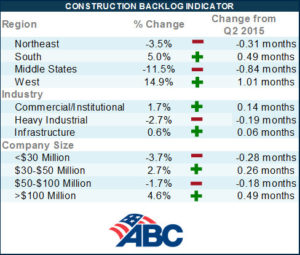

South Receives Highest Level of Construction Backlog in History

The backlog of commercial and industrial construction projects reached 10.3.

The backlog of commercial and industrial construction projects reached 10.3 months in the South, the highest reading in the history of the Construction Backlog Indicator (CBI), according to third-quarter results announced by Associated Builders and Contractors. Nationally CBI remained virtually unchanged at 8.5 for the quarter, although it has declined by 3.5% year-overyear, indicating that the nonresidential construction backlog has stabilized at a high level.

“Nonresidential construction remains one of the nation’s leading engines of economic growth,” said ABC Chief Economist Anirban Basu. “Industry spending is up 11% on a year-over-year basis, and the most recent backlog indicator strongly suggests that construction volumes will continue to recover. Unlike prior years, both the private and public sectors are now contributing to spending growth.

“While rapid economic growth continues to elude America, the economy has been strong enough to produce more than 2.6 million net new jobs over the past year,” said Basu. “Wage growth is poised to accelerate and residential markets continue to improve, with single family activity picking up recently and home prices continuing to edge higher in many communities. This implies ongoing support for commercial construction and stable tax collections or better, which ultimately translates into more public works projects.”

Regional Readings

Despite significant investment in components of the auto sector, including in industrial facilities, declines in commodity prices have dramatically reduced investment levels in states ranging from North Dakota to Ohio. Backlog in the Middle States now stands at 6.5 months, the lowest regional reading and a level not much different from the beginning of 2011.

Industry Highlights

- For a second consecutive quarter, backlog in the heavy industrial category stood at more than 7 months. Prior to the last two quarters, backlog had never been above 7 months in the history of the CBI series.

- For a 13th consecutive quarter, backlog in the commercial/institutional category stood at more than 8 months. Backlog in this category has not exceeded 9 months during the history of the series.

- For a fifth consecutive quarter, infrastructure backlog stood above 9 months. It is likely that backlog will soon exceed the 10 month threshold.

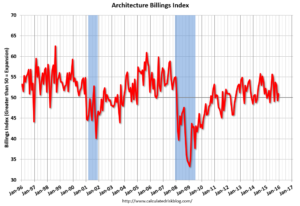

Architectural Billings Index Ends Year on Positive Note

There were a few occasions where demand for design services decreased from a month-to-month basis in 2015, but the Architecture Billings Index (ABI) concluded the year in positive terrain and was so in eight of the twelve months of the year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the December ABI score was 50.9, up from the mark of 49.3 in the previous month. This score reflects a slight increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.2, up from a reading of 58.6 the previous month.

“As has been the case for the past several years, there continues to be a mix of business conditions that architecture firms are experiencing,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Overall, however, ABI scores for 2015 averaged just below the strong showing in 2014, which points to another healthy year for construction this year.”

Key December ABI highlights:

- Regional averages: West (53.7), South (53.3), Northeast (46.7), Midwest (46.1),

- Sector index breakdown: multi-family residential (52.9), institutional (52.2), commercial / industrial (47.3), mixed practice (46.5)

- Project inquiries index: 60.2

- Design contracts index: 51.0

The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

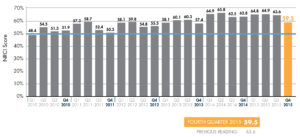

The Environment is Too Chaotic to Predict. Remain Claim, All is Well.

Panelists have dropped their outlook for the economy in general this quarter, but they are still within a range expecting growth in the coming year. Some of the reasons for these drops can be seen in our “current issues” questions concerning uncertainty, optimism levels and shortages of skilled workers. Compared to the same questions last year for uncertainty and optimism, panelists haven’t changed their ratings much. They continue to be moderately uncertain about what will happen in the economy in the coming year or so, and, at the same time, they continue to be quite optimistic, but cautiously so. Again, looking at the detail behind the overall NRCI score, confidence levels for almost all market sectors have dropped, but remain within positive growth areas (with the exception of the long-range lodging expectation). The median backlog for all respondents is higher than it has been since the beginning of the recession when we started the NRCI, but expectations for backlog growth have gone down.

Overall Economy: Down

NRCI panelists’ outlook for the overall economy dropped sharply for Q4, down 12.3 points from last quarter to 58.3.

Overall Economy Where Panelists Do Business: Down

The NRCI component for panelists’ own business dropped less sharply than for the overall economy, from 73.3 to 64.8 this quarter, but still a sign that expectations have been lowered as we head into the new year.

Panelists’ Construction Business: Down

Panelists’ business, for the most part, is carrying good momentum as business has been improving, but the momentum is beginning to slow to drop this component by 5.8 points to 69.9, still in strong growth territory.

Nonresidential Building Construction Market Where Panelists Do Business: Down

While most panelists report their own business as holding strong, their opinion of the general nonresidential construction market is less exuberant this quarter, moving from 75.7 to 65.3.rs.

Expected Change in Backlog: Down

Backlogs for those participating in the NRCI survey have reached the highest level since we started this report. Now at a median of 12 months, panelists expect that rate to cool in 2016 as the component score dropped from 68.2 to 62.2 this quarter.

Cost of Construction Materials and Labor: Lower

The component for cost of construction materials was little changed from last quarter, improving 1.2 points to 30.6, indicating costs are still increasing. The cost of labor increased less sharply than last quarter, but it too is showing more increases. Generally, it is expected that costs will rise as business improves, thus holding down the overall NRCI index number.

Productivity: No Change

Once again this quarter, there is little improvement in productivity, now at 47.9, or remaining under the midrange of 50. Productivity appears to be the most difficult area to improve, especially when backlogs are growing and it is difficult to find experienced workers to help grow the business.

Basu, A. (2015, December 16). Construction Backlog Indicator. Retrieved February 3, 2016, from Associated Builders and Contractors, Inc.: http://www.abc.org/NewsMedia/ConstructionEconomic /ConstructionBacklogIndicator/tabid/272/entryid/4792/south-recordshighest- level-of-construction-backlog-in-history.aspx

Hon, K. (2016, January 20. Architectural Billings Index Ends Year on Positive Note. Retrieved February 3, 2016, from The American Institute of Architects: http://www.aia.org/press/releases/AIAB107965

Warner, P. (2015). 2015 NRCI 4th Quarter. FMI Corporation. Retrieved from https://www.fminet.com/resources