Miles-McClellan Makes ABC’s 2019 Top Performer List

Associated Builders and Contractors (ABC) named Miles-McClellan Construction as a 2019 Top Performer which recognizes ABC members’ achievements in safety, quality, diversity and project excellence ranked by work hours, with special designations identified.

Associated Builders and Contractors (ABC) named Miles-McClellan Construction as a 2019 Top Performer which recognizes ABC members’ achievements in safety, quality, diversity and project excellence ranked by work hours, with special designations identified.

We ranked 148 of 150 (nationally) – we’ll take it!

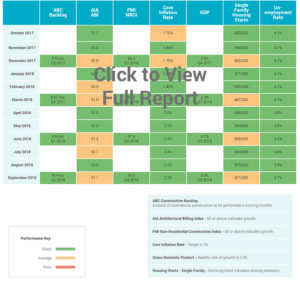

Q2 2019 Economic Indicators

We’ve lived and worked through one of the longest economic expansions in history. So what’s coming next? The more I study it, the more confused I get – but here are some of the facts and trends as I see them.

We’ve lived and worked through one of the longest economic expansions in history. So what’s coming next? The more I study it, the more confused I get – but here are some of the facts and trends as I see them.

The US Consumer is strong and is keeping our economy growing. The unemployment rate remains below 4%. Gross Domestic Product is still above 2%, and the stock market continues to push all-time highs. On the other side of that coin, there’s still a lot of economic uncertainty. We have an ongoing trade war with China. International central banks are keeping their interest rates below zero. The US Federal Bank is balancing between a strong US dollar, a strong economy and a political push for lower interest rates.

Confused? Me too. I study the construction numbers that I understand – the Architectural Billing Index (ABI), the Associated Builders and Contractors’ Backlog Indicator, and the FMI Non-Residential Construction Indicator NRCI). These three indicators are generated by industry-specific groups taking surveys from their members. I participate in both the ABC and FMI surveys.

If I look at the three surveys individually, here is what I think is next.

ABC’s Backlog Indicator has been running very consistent between 8-9 months. I participated in the survey on August 25th and calculated our backlog at 8.8 months. We’ve been between an 8-11 month backlog during the past three years – so I don’t see an immediate concern.

FMI’s NRCI is an executive opinion of the construction industry’s health. Above 50 is positive, and tends to fluctuate between low-40s and high-50s. This current survey results of 53.3 support the results seen in the ABC Backlog survey. Together these two measurements show a construction industry that continues at a steady, positive pace.

However, the true lead indicator for our industry is the AIA Architectural Billings Index. This survey has a baseline of 50. If fees are growing, the survey results are above 50, and if fees are shrinking, the results are below 50. This indicator is pretty accurate and shows me what construction looks like 8-12 months from now. The past five months shows fees holding steady to decreasing. This tells me that I am going to have to work harder to find construction opportunities in the spring of 2020.

Moving forward, I will keep a close watch on the ABI and our backlog levels to see how they correlate. I will share some of the early results in the 3rd Quarter Economic Indicator report.

I invite you to share what you see from these three indicators (ABC Backlog Indicator, AIA ABI, FMI NRCI). Where do you think the economy is going next?

Q1 2019 Economic Indicators

The U.S. economy grew 2.9% in 2018. While the economy is growing, GDP’s declining trend (Q1 = 4.1%, Q3 = 3.5%, Q2 = 2.2%, Q4 = 2.2%) signals growth is slowing. “In 2018, momentum accelerated. In 2019, we will see momentum decelerating. The inflection point was really the fourth quarter last year,” said Gregory Daco, U.S. economist at Oxford Economics. “This does not mean we’re headed for a recession. It just means growth will slow to about 2% this year and next.” (Long, 2019)

The U.S. economy grew 2.9% in 2018. While the economy is growing, GDP’s declining trend (Q1 = 4.1%, Q3 = 3.5%, Q2 = 2.2%, Q4 = 2.2%) signals growth is slowing. “In 2018, momentum accelerated. In 2019, we will see momentum decelerating. The inflection point was really the fourth quarter last year,” said Gregory Daco, U.S. economist at Oxford Economics. “This does not mean we’re headed for a recession. It just means growth will slow to about 2% this year and next.” (Long, 2019)

Despite the anticipated slow down, ABC’s Chief Economist Anirban Basu believes the demand for nonresidential construction services will remain elevated for the foreseeable future. “A major source of influence is the reemergence of public construction spending,” said Basu. “With nearly 10 years of economic expansion complete, many state and local governments are experiencing their best fiscal health in years, resulting in more funds to invest in roads, transit systems, schools, fire stations, and police stations. The combination of spending growth in certain private construction categories and rising infrastructure outlays will keep the average American nonresidential contractor scrambling to retain and recruit workers, especially in the context of a national rate of unemployment effectively at a 50-year low.” (Basu, 2019)

Results from the ABC’s Construction Confidence Survey showed that 70% contractor expect to increase staffing levels, and 56% anticipated rising profit margins.

In March, the AIA’s ABI dropped to 47.8 for the first time in two years. The AIA does point out the fact it was a hard winter and even though the ABI dropped below 50, backlog is at 6.5 months. Again, this does not indicate a recession, especially since “consumer finances remain generally strong, that financial market conditions are not currently too restrictive, and that the commercial construction sector is not yet overbuilt.” (Bryson & House, 2019)

Do you anticipate increasing staff levels? How has your 2018 influenced your 2019? We continue to focus on steady, strategic growth, delivering technical excellence, and satisfying our partners and clients. Whatever the economy brings us this year, we’ll be ready to continue to perform at our best and help our clients manage their projects in the most cost-effective, efficient ways possible.

References

Basu, A. (2019, May 23). Construction contractors confidence remains high in March. Retrieved from www.abc.org: https://www.abc.org/News-Media/News-Releases/entryid/16313/construction-contractors confidence- remains-high-in-march

Bryson, J., & House, S. (2019). U.S. Recession? How Do We Count the Ways? Wells Fargo. Retrieved from https://www08.wellsfargomedia.com/assets/pdf/commercial/insights/economics/special-reports/recession-20190401.pdf

Long, H. (2019, March 28). GDP revised downward for 2018 as U.S. economy shows more signs of slowing. Retrieved from www.washingtonpost.com

Q4 2018 Economic Indicators

We know a recession is coming, but we do not know when. In the 2019 FMI Overview, FMI reminds us that now is the time to prepare for the next downturn while the market is still good. To prepare, FMI put together a list of the top lessons learned from the last recession.

We know a recession is coming, but we do not know when. In the 2019 FMI Overview, FMI reminds us that now is the time to prepare for the next downturn while the market is still good. To prepare, FMI put together a list of the top lessons learned from the last recession.

- Do not wait too long to make any hard decision you have been deferring.

- Find your sweet spot and do not just follow the herd.

- Work on the new, envisioned future and set the strategy for post-recession success.

- Get a grasp on “incremental economics” like revenue, margin, and overhead.

- Maintain a healthy balance sheet in the context of growth plans.

- Get positioned in your market early.

- Get more feet on the street.

We are looking ahead and cautious, and we will be ready when the recession hits. Will you be ready?

Q3 2018 Economic Indicators

Executive Summary

The labor shortage over the past years has caused wages to escalate. According to a report by Zillo Research, at the start of 2017, wages for construction-industry workers were growing slightly slower than wages for other workers – around 2.5% per year. But they are now growing 3.8% per year. This is happening for both skilled laborers and salaried positions. Anirban Basu, ABC’s Chief Economist, states in a Nov. 1 construction employment news release, “one potential cause for concern is growing evidence that wages have begun to rise much more rapidly of late. That, along with other sources of inflation, can be expected to push interest rates higher, which in turn would ultimately translate into more expensive financing for construction projects and fewer construction starts. But for now, it is all systems go for the U.S. nonresidential construction industry.” We’ll be keeping a close eye on how this might impact the industry.