2015 3rd Quarter Ecomonic Indicators

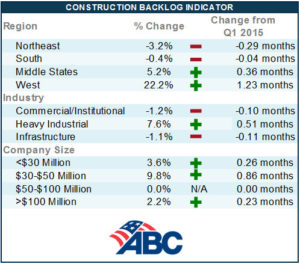

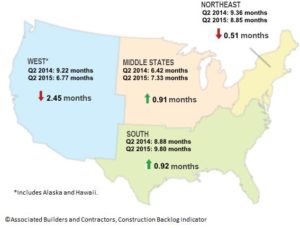

Construction Activity Increases as Backlog Edges Higher

“The nation’s nonresidential construction industry is now one of America’s leading engines of growth,” said ABC Chief Economist Anirban Basu. “The broader U.S. economic recovery is now in its 74th month, but remains under-diversified, led primarily by a combination of consumer spending growth as well as residential and nonresidential construction recovery. Were the overall economy in better shape, the performance of nonresidential construction would not be as closely watched. The economic recovery remains fragile despite a solid GDP growth figure for the second quarter, and must at some point negotiate an interest-rate tightening cycle. Recent stock market volatility has served to remind all stakeholders how delicate the economic recovery continues to be.

“The national outlook continues to be positive,” said Basu. “The most consistently upbeat information regarding U.S. economic performance continues to emerge from the labor market. The nation added more than 2.9 million jobs between July 2014 and July 2015, enough to help drive down office and other commercial vacancy rates in many major markets despite ongoing construction.

“Also consider the tendency for commercial construction to follow residential construction. To the extent that remains true, the recent uptick in residential starts should translate into more commercial starts going forward. All of this should set the stage for further rebounds in CBI during the quarters to come, even in the absence of a long-term policy regarding infrastructure investment in the U.S.”

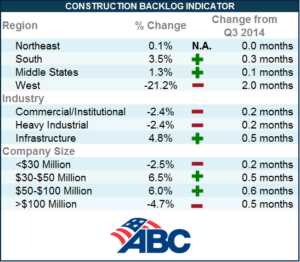

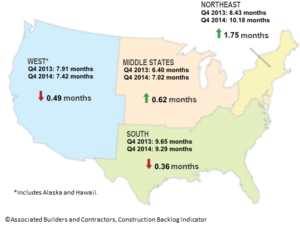

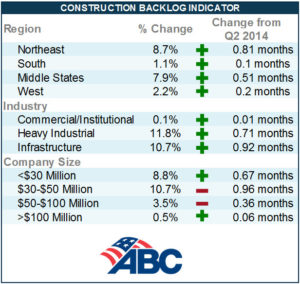

Industry Highlights

- Backlog in the heavy industrial segment has never been higher during the length of the series, penetrating the seven-month mark for the first time. This represents an increase of more than two months in average backlog over the past two years. Average backlog was below five months during 2013’s second half.

- Industrial backlog has continued to rise despite the strength of the U.S. dollar, which has contributed to limited export growth.

- Commercial/institutional backlog has remained above eight months on average for twelve consecutive quarters, a reflection of America’s steady rate of employment expansion.

- Backlog for all industry segments is higher on a year-over-year basis with exception of the commercial/institutional segment. Commercial/institution construction segments have been among the most active from a construction.

- Spending perspective in recent years. Therefore, the small adjustment in average backlog is not particularly worrisome.

Basu, A. (2015, September 9). Construction Backlog Indicator. Retrieved October 22, 2015, from Associated Builders and Contractors, Inc.:http://www.abc.org/NewsMedia/ConstructionEconomic/ConstructionBacklogIndicator/tabid/272/entryid/4373/construction-activityincreases-as-backlog-edges-higher.aspx.

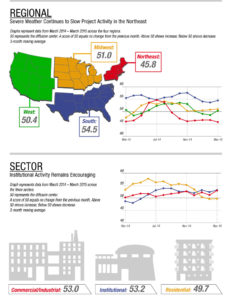

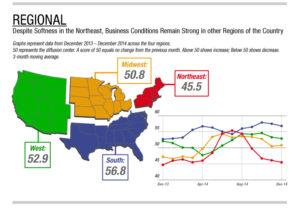

Strong Rebound for Architecture Billings Index

“Aside from uneven demand for design services in the Northeast, all regions are project sectors are in good shape,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Areas of concern are shifting to supply issues for the industry, including volatility in building materials costs, a lack of a deep enough talent pool to keep up with demand, as well as a lack of contractors to execute design work.”

Key September ABI highlights:

- Regional averages: South (54.5), Midwest (54.2), West (51.7) Northeast (43.7)

- Sector index breakdown: mixed practice (52.6), institutional (51.5), commercial / industrial (50.9) multi-family residential (49.5)

- Project inquiries index: 61.0

- Design contracts index: 53.2

Hon, K. (2015, October 21). Strong Rebound for Architecture Billing Index. Retrieved October 26, 2015, from The American Institute of Architects:http://www.aia.org/press/releases/AIAB107451

The Index Dropped only 1.3 Points to a Still Positive 63.6 this Quarter, 1.1 Points Ahead of Q3 2014

Construction companies are busy, and they are busier than they were last year at this time. However, there is some slippage in optimism about the economy and specifically the individual markets looking a year out and past the election year. The message is subtle and open to interpretation or other theories, but it appears that a number of forces are at work here. One is that many companies are struggling to take on more work with fewer well-trained employees. The recovery for construction post-recession has been gradual, but that gradual change has opened up a rift between the need for work and the need for more workers. Backlogs have increased for most companies and, for some, to the point of making it more difficult to sell more work. That is a better problem than finding no work, but still a problem.

Overall Economy:

At 70.6, NRCI panelists’ view of the overall economy is optimistic; however, it is 6.3 points less optimistic than last quarter and at the lowest point in the past year.

Overall Economy Where Panelists Do Business:

Looking at the economy for the markets in which panelists’ companies operate, a score of 73.3 this quarter indicates a strong outlook, although this component slipped 3.4 points from last quarter.

Panelists’ Construction Business:

Panelists’ view of their own business in the current economy is solidly positive at 75.7, with little change for the last three quarters.

Nonresidential Building Construction Market Where Panelists Do Business:

Although we see some slippage in most index components, a score of 75.0 for this component still registers in the optimistic range, as it has been over 70.0 for the last seven quarters.

Expected Change in Backlog:

The backlog component of the NRCI dropped 3.1 points from last quarter to 68.6. For the third quarter in a row, the mean backlog of all responses is 10 months with a high of 30 months and a low of just three months.

Cost of Construction Materials and Labor:

The cost of labor continues to be higher, but little change from last quarter at 12.5. Materials costs continue to be high, but slightly lower than last quarter. These two major components of construction costs act to hold down the overall NRCI as costs increase.

Productivity:

Improvements in productivity can help to overcome increases in labor and materials costs. However, this component dropped 3.4 points to just 47.6 this quarter. This is the lowest score for productivity we have seen since the NRCI began in 2008. As backlog climbs and skilled labor is in high demand, contractors find themselves in a position of trying to do more work with greener crews.

Warner, P. (2015). 2015 NRCI 3rd Quarter. FMI Corporation. Retrieved from http://www.fminet.com/nrci3q15.html